Investing in Nigerian treasury bills (T-bills) is one of the safest and most reliable ways to preserve and grow your money in Nigeria. Irrespective of your investment experience, T-bills offer a low-risk option with decent returns. But how exactly do you invest in them? What are the steps, and what should you know before diving in? In this guide, we’ll break down everything you need to know about Nigerian t-bills. How they work, where to buy them, and the pros and cons. By the end, you’ll be ready to start investing confidently.

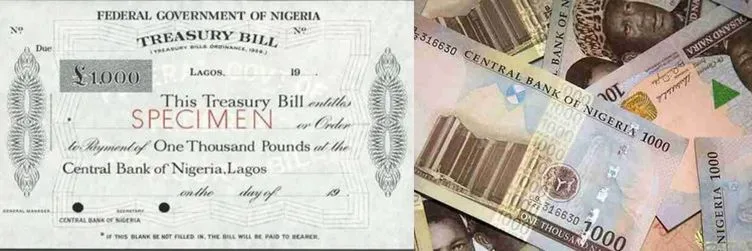

What Are Nigerian Treasury Bills?

Nigerian treasury bills are short-term debt instruments issued by the Central Bank of Nigeria (CBN) on behalf of the federal government. They’re used to raising funds for government projects while offering investors a secure way to earn interest.

T-bills come in three tenors:

91 days (3 months)

182 days (6 months)

364 days (1 year)

The best part is that they’re virtually risk-free since they’re backed by the Nigerian government. Nigeria is not going to disappear anytime soon.

Why Invest in Nigerian Treasury Bills?

Before jumping into how to invest, let’s talk about why Nigerian t-bills are a great option:

1. Low Risk: Since the government backs them, the chance of default is extremely low.

2. Good Returns: While not as high as stocks or crypto, T-bills offer better interest than regular savings accounts.

3. Liquidity: You can easily sell them in the secondary market if you need cash before maturity.

4. No Hidden Charges: Unlike mutual funds or stocks, T-bills have minimal fees.

5. Flexible Tenure: Choose between 3 months, 6 months, or 1 year based on your financial goals.

If safety and steady returns are your priorities, Nigerian treasury bills should be on your radar.

How to Invest in Nigerian Treasury Bills

Now, to the main question; how do you actually invest in Nigerian treasury bills? Here’s a step-by-step breakdown:

1. Open a Bank Account or Use a Broker

To buy T-bills, you’ll need a bank account with a Nigerian commercial bank or a licensed brokerage firm. Most people go through their banks because it’s straightforward.

2. Complete the Treasury Bill Application Form

Your bank will provide a form where you specify:

The amount you want to invest

The tenor (91, 182, or 364 days)

Your preferred bid type (competitive or non-competitive)

3. Choose Between Competitive and Non-Competitive Bidding

Competitive Bidding: You propose an interest rate (yield). If your bid is too high, you might not get allotted.

Non-Competitive Bidding: You accept the rate determined at the auction. This is easier for beginners.

4. Wait for Allotment

The CBN holds auctions every two weeks. If your bid is successful, your bank will debit your account, and you’ll receive a confirmation.

5. Earn Interest & Get Your Money at Maturity

T-bills work on a discount basis. You pay less than the face value and get the full amount at maturity. For example, if you want to invest ₦1,000,000 in a 364-day T-bill with a 15% yield, you will be debited ₦850,000 while you still get your ₦1,000,000 at the end of the year. You’ll receive the 15% interest upfront in T-bills.

Where Can You Buy Nigerian Treasury Bills?

You can invest in Nigerian treasury bills through:

- Commercial Banks (GTB, Zenith, Access, UBA, etc.)

- Primary Market Auctions (via the CBN)

- Secondary Market (if you want to buy/sell before maturity)

Most retail investors go through banks because it’s hassle-free.

Pros and Cons of Nigerian Treasury Bills

Pros:

Safe Investment: Backed by the government.

Predictable Returns: No surprises.

Short-Term Commitment: Choose between 3 months to 1 year.

No Taxes: T-bill earnings are tax-free.

Cons:

Lower Returns – Compared to stocks or real estate.

Inflation Risk – If inflation rises, your real returns may drop.

Not Ideal for Long-Term Growth – Better for preserving capital than building wealth.

Conclusion

Nigerian treasury bills are perfect if you want a secure, low-stress investment with decent returns. They’re easy to buy through banks, offer flexible tenures, and are ideal for risk-averse investors. If you’re looking for a way to park your money without worrying about market crashes, Nigerian treasury bills might be your best bet.

Are you ready to start? Contact your bank today.

Leave a Reply